Commercial banks in worse downtime, shut out depositors

• USSD services of operators inactive for days

• Ex-CIBN boss tasks CBN to comply with Supreme Court order

• Zaka: Make N200 our highest denomination

A week after the Supreme Court delivered its final ruling in the lawsuit on the old banknotes and extended their validity to December 31, the Central Bank of Nigeria (CBN) is yet to formally give a directive to deposit money banks (DMBs), stoking confusion over the status of the contentious N500 and N1,000 notes.

This silence has triggered discretional positions by different banks, leading to widespread confusion among depositors. Many banks have even issued a few old notes in their vaults, but not many receive the same currencies they dispense from customers willing to deposit.

The double standard among the financial institutions is halting circulation of the old notes as traders similarly turn them down when offered in exchange.

A few banks that are willing to receive the disputed notes insist customers complete the CBN’s cash swap form, which implies that their accounts would not be credited immediately.

In the worst case, customers are vaguely asked to go to banks where the notes were issued to make deposits.

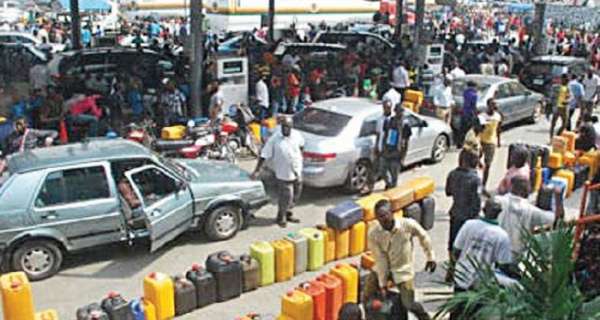

The hassles created have fueled the number of traders rejecting the old notes. As at yesterday, most traders in Lagos had joined the rejection list. A few will receive but with a premium.

The worry, however, about the cash crunch does not stop at rejection of old notes. In the past three days, some banks’ electronic payment channels have suffered severe downtime.

Customers are worried they have been shut out of their accounts, thus, compounding the pains of the naira redesign policy.

The other option for desperate individuals is banking halls. Sadly, most banking halls are either crowded or not open to customers.

Checks by The Guardian, yesterday, showed that some had waited at bank premises for hours to gain access to officials to help execute funds transfers or register complaints of failed transaction, but were denied access by security personnel who claimed bank halls were crammed.

Many branches open late and close as earlier as 2:00p.m. or 3:00p.m. to reduce the growing ‘irritations’ from customers. But experts and customers said the sudden reversal of the ancient marketing mantra – ‘customer is king’ – will not help in confidence-building.

Indeed, confidence is ebbing. At an old generation bank in Lagos, a customer told The Guardian he would rather damn the risk and keep his money at home if it were possible.

“For two days, I live off my wife. I am smart enough to sort myself out if the problem is only cash. But transferring from the two banks I use has been impossible. I have bills to pay; I have money to clear the bills, but I cannot access my accounts. What could be worse than that?” the customer lamented.

Bank customers have taken to social media to protest inactive unstructured supplementary service data (USSD) and sluggish or frozen bank mobile applications since Tuesday.

There have been online speculations that some banks have changed their USSD codes, hence, the existing ones are not effective. But no bank is forthcoming with a clear statement on the issue.

Most banks’ spokespersons avoid commenting on the crisis. One of them who spoke on the condition of anonymity told The Guardian there is nothing unusual about the challenge, which he said is a result of congestion.

“It is natural. Everybody wants to transact at the same time, so you cannot rule out congestion. Hopefully, we will get out of it soon,” he said.

As Nigerians grapple with lethargic electronic payment, President of the Association of Corporate Affairs Managers of Banks (ACAMB), Rasheed Bolarinwa, said banks had invested over N100 billion in support infrastructure and that they were ready for the aggressive cashless policy implementation.

Meanwhile, former president, Chartered Institute of Bankers of Nigeria (CIBN), Mazi Okechukwu Unegbu, has tasked CBN to comply with the ruling of the Supreme Court that the old notes should remain legal tender till December 31. He also asked banks to start re-circulating the deposited notes.

According to him, “there is nothing CBN can do with the decision of the Supreme Court other than to obey and allow the re-circulation of old notes.

“If CBN refuses to comply with the Supreme Court now, then we will have to wait till May 29 when the new government will take over power to instruct the apex bank to reverse the decision on the naira issue.”

ON his part, a public affairs analyst, Bala Zaka, has implored CBN to use the opportunity of this cash squeeze to make N200 the nation’s highest denomination.

According to him, considering the micro and macroeconomic activities interplay, he suggested, “this is the best time to withdraw the N1,000 and N500 bills out of circulation because we honestly don’t need them.

“We should use this opportunity to make N200 our highest denomination and that will help in deepening the cashless policy and even reduce crime, because if you analyse it critically, you will agree with me that kidnapping for liquid cash ransom by bandits and criminals has really gone down. Ransoms paid through banks and other electronic media can easily be traced and the criminal hunted and smoked out.”

He added that more N200 and lower bills should be pumped into circulation.

0 Comments