The recent naira redesign and currency swap policy by the Central Bank of Nigeria was controversial from the beginning, as it divided both commentators and analysts. The whole country was talking about it. While many were willing to give it a chance, most saw the policy as more political than economic, others however, including me, saw it as a reset for the CBN.

The CBN admitted upfront, when it made the policy known, that it lost control of the currency in circulation, with about 80 per cent of the currency in circulation outside the banking system. For this writer, this was a good enough reason to give the policy support.

It was thought that the large cash in the system has implications for inflation, and also thought to be the major fuel for much of the corruption we see around us, and the kidnapping business that has grown in leaps and bounds in recent times. It was also seen, to some extent, as a way to reduce the vote buying tendencies of our politicians.

No matter what side of the debate you are, no one foresaw the large-scale mismanagement and the widespread suffering that this policy was to create.

Adding to the chaos are conflicting court orders, policy challenges and litigation. It is taking us back to 1983 when the Supreme Court in Nigeria said they have no jurisdiction in the Abiola matter. The rest is history as they say. If that decision had been otherwise, Nigeria may have taken a different trajectory.

We are again seeing a situation where the highest judicial officer in the land, the Attorney-General of the Federation, Abubakar Malami, says the Supreme Court has no jurisdiction to intervene in the matter. What is the import of the AGF’s statement? We are not yet sure what that means.

Does that mean the government will not obey the ruling and what will be the implication of that? Is the Supreme Court no longer the final arbiter in any judicial matter in the land? Are we not heading for anarchy with this posturing? I think we should obey the Supreme Court no matter what the technical legal position might be.

This was more a social ruling needed to give respite amid the confusion and suffering around. What is legally right, at this point, has to take everything happening into consideration.

The confusion the CBN has caused by its mismanagement of the currency swap policy can only be remedied by a temporal halt on the deadline for the old notes to remain legal tender. The fact that the new notes are not available and may not be massively available in the few days left, means that unless there is a shift in the position, the crisis and suffering will continue and the economy will take a huge hit, and may even lead to another recession; something we cannot afford now.

The economy is already in trouble and a recession will have bad implications for a long time to come. The amazing aspect of this mismanagement is the fact that the information we are now getting was available to the CBN to plan with. The CBN knows there is a large population of the unbanked. It knows that the telecom infrastructure is already stretched and a large demand on its services at this time will create more problems. We have seen how overwhelmed the system experienced in the last few days. Those who wanted to bank on their phones were unable to do so. The CBN knew the capacity of our Mint, and should have made adequate preparation to match the capacity, with the expected amounts of the new notes to be swapped.

The claim that the Mint does not have sufficient papers to print the new notes has been denied by the CBN. The CBN should have been prepared to match the printing of the new notes, with the amounts the banks were taking in, in old notes, in real time. In today’s world of instant data availability, the CBN was in a position to get reports from banks that could have aided the Mint in reacting to the demand for new notes to continuously match what the banks were taking into their vaults daily.

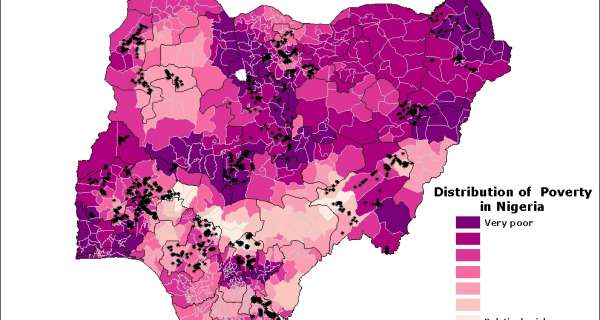

If it is true that only N500bn was available on the day of the first deadline to replace over N2tn naira of the old notes the CBN said was already with the banks, then it is responsible for this manufactured chaos. There is no way to explain such bad planning. It was also bad planning that no special arrangements were made for the large unbanked population; those without bank accounts estimated at 66 per cent of the population, as reported by some media outlets.

It was ridiculous that this category of people was not taken into consideration in CBN planning.

The fact that only nine per cent of the population use digital banking outlets makes arrangements for special outlets to be even more important. Setting up several cash points in every Local Government Area, especially those that have no bank branches, was a necessity. Even in the 1984 currency swap that was also difficult to manage, there were opportunities for the rural populace who had no banking facilities to go to their local government offices to make a swap of their old notes. Why didn’t the CBN not even think of this by refusing completely to learn from history?

The emergency recruitment of 400 PoS operators was an afterthought, and would have worked better. If this was part of the strategy to get to the unbanked population, it is an opportunity to use this outlet. The initial instruction to banks to restrict disbursement of the new naira notes via ATMs only was also a bad strategy.

No one knows what it was supposed to achieve. There are not enough ATMs as it were and most of them work badly frequently. Thus, relying on this for wide distribution was a one-way thinking to fight the black money in the system and hinder politicians from having money to buy votes. This thinking completely forgot that the economy was a much bigger deal to worry about.

The statement credited to the CBN Governor, Godwin Emefiele, that they didn’t anticipate the challenges and the ensuing crisis clearly indicated that there was no impact assessment. This is unforgivable. Public policy options that will affect everyone in the country require proper assessment and the impact measured to offer policy-makers adequate preparation against challenges and alternatives put in place. Let’s hope this will all be sorted out quickly as the mistakes were avoidable. Despite this huge disruption to our lives and the impact it will have on the economy, there are still some benefits that are derivable when it all unfolds

0 Comments