The chaos trailing the cash scarcity has assumed a worrisome dimension with the organised private sector raising the alarm that the crisis has grounded the economy.

Members of the organised private sector including the Lagos Chamber of Commerce and Industry, Nigerian Employers Consultative Forum, Nigerian Economy Summit Group, Nigerian Association of Small and Medium Enterprises and the Nigerian Association of Small-Scale Industrialists.

This happened as the cash scarcity sparked another round of violence in Ogun State, on Monday, resulting in the razing of two banks and the destruction of the local government council secretariat in Sagamu.

Speaking on the impact of the cash shortage on the economy, the Director-General of the Nigeria Employers Consultative Association, Wale Oyerinde said the situation had created massive disruptions in the flow of transactions, even as e-payment channels continued to fail.

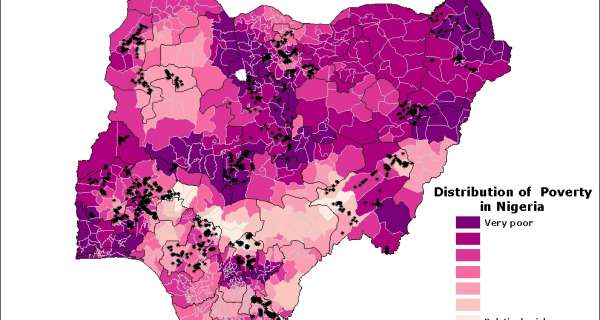

Oyerinde said, “The impact is already obvious. The cash squeeze is already creating massive disruptions in the flow of transactions. The MSMEs are struggling, and the survival of the informal sector and the un-banked in the rural areas is already being compromised. We cannot pretend that all is well.

“The online banking portals and mobile infrastructure continue to fail, causing further hardship to businesses and Nigerians. While the release of the N200 notes will give some relief, it is hoped that the damage that has been done will be reversed gradually.

Report has show that, “Long and unending queues are now common at banks as people often try unsuccessfully to withdraw cash. Time spent attempting to obtain new notes disrupts economic activities; makes it significantly difficult for people to engage in daily activities, as commuting becomes difficult or even impossible when cash is not in hand and when economic agents are not receptive to e-payment/bank transfers.”

Also noted that the failure of deposit money banks to meet the growing demands for cash suggests that the banking system, given the existing technology, was unprepared for a sudden transition from the old naira notes to the new ones or a cashless economy.

The Deputy-President of the Lagos Chamber of Commerce expressed concern that the Gross Domestic Product for the first quarter of the year would be significantly impacted as businesses have been unable to operate at optimal levels due to the naira scarcity that has forced down consumer spending power.

According to Idahosa, the cash scarcity has been significantly exacerbated by political actors who are hoarding as much currency as they can for vote-buying during the forthcoming general elections.

He said, “It is not likely to continue for a long time. It is already having a short-term impact. Certainly, in February, national industry productivity, sales, travel and other sectors will show reduced levels of operations. People are grounded. A significant amount of the new notes are in the hands of people who are preparing for elections, and once that objective is achieved, the money will go into circulation.’’

“Even if it was just N300bn new notes that were printed, we would not have the kind of crisis that we have now if the N300bn were circulating. Everybody that wanted N10,000 from the ATM or over-the-counter should have been able to get it.’’

Also lamenting the naira crisis, the Chairman of the Nigerian Association of Small and Medium Enterprises, Lagos State Chapter, Dr Adams Adebayo, said it was worrisome that the naira chaos had grounded the economy, adding that the situation had had a serious negative impact on SMEs.

He said, “The crisis is uncalled for. Micro, Small and Medium Enterprises are the worst hit by this unpopular policy of the CBN. The prices of goods have gone up and the ease of doing business is far away from us in Nigeria.

“The Federal Government should look beyond the politics of the naira redesign and focus on the damaging effects on businesses and the economy at large. The value chain in the formal and informal sectors with over N5bn cash transactions daily is almost destroyed with consequences for employment, business sustainability and national development.’’

“It was unfortunate that too much attention has been placed on the politics of the naira redesign with the government and the Central Bank of Nigeria, shifting attention away from the damaging effect of the cash squeeze on businesses and the already fragile and damaging economy.’’

Small scale industries

However, the Vice-President of the Nigerian Association of Small-Scale Industrialists, Seun Kuti-George, said though the naira crisis would harm the economy, it was not capable of destroying the economy.

Meanwhile, the President of the Bank Customers Association of Nigeria, Dr Uju Ogubunka, has further lamented the impact of the CBN policy on the masses.

He said, “Of course, more customers are facing hardship including myself. No matter the amount of transfer you do, you cannot buy certain goods that require cash. Most of the things you buy are in the open market.

However, dozens of customers were seen hanging around the ATMs, lamenting the hardship caused by the cash crisis.

It was observed that a few people that wanted to deposit their old N500 and N1000 notes were not attended to by the bank.

Also, the DMBs, which were besieged by thousands of customers, failed to pay their clients. They claimed they had no cash to dispense.

The development took a severe toll on businesses in the FCT as many small businesses could not carry out commercial operations.

Thousands of customers thronged the banks as early as 6.30am and waited patiently for hours, with the hope that the financial institutions would either load their ATMs or dispense cash over-the-counter but there was no respite for the customers.

While Access Bank subsequently paid its customers a maximum of N5,000, GTBank did not commence payment for several hours, despite keeping hundreds of customers waiting under the sun.

At many other banks, it was observed that customers could not access the new notes or the old N200 notes as the DMBs complained of naira scarcity.

An official who preferred anonymity blamed it on the failure of the apex bank to supply cash allocation for the day.

It was learnt that the public anger and frustration boiled over after the Automated Teller Machines in the town also stopped dispensing cash for the past week.

A similar protest rocked Abeokuta, the state capital, on February 7 and it resulted in attacks on ATM points.

The rioters also blocked the Sagamu-Benin Expressway and prevented human and vehicular movements.

The protesters in their numbers subsequently invaded the Sagamu Local Government secretariat and carted away the mace of the council legislature.

They also reportedly destroyed the glass windows and pulled down the doors at the secretariat.

The mob equally razed the branches of Keystone Bank and Union Bank in the town.

The council Chairman, Afolabi Odulate confirmed the development.

“Yes, they did invade the secretariat. No one was attacked. We had moved workers away before they arrived here. They stole the mace. Yes, they did, “ Odulate said.

He, however, said normalcy had returned as police and soldiers had taken over the community.

The police said it had arrested 27 suspects in connection with the riot.

The Police Public Relations Officer in the state, Abimbola Oyeyemi disclosed in a statement that normalcy had returned to the area.

He said, “Normalcy has been restored in greater parts of Sagamu now. CP Frank Mba is personally leading police teams and some military men to tackle the situation. About 27 suspects have been arrested.”

But a youth leader in the town, Kayode Segun-Okeowo condemned the development, describing the incident as a “motivated destruction and not a protest.”

He noted, “This is not a protest. I’m a comrade and understand the ABC of protest. It’s motivated to cause destruction. Those behind this must be stopped.”

On the heels of the violence provoked by the cash scarcity, the President, Major General Muhammadu Buhari (retd.) had last week directed that the old N200 notes be allowed to co-exist with the new notes till April 10 while the old N500 and N1000 notes remained invalid.

The directive in violation of the order of the Supreme Court that the Federal Government should suspend the February 10 deadline for swapping the old naira notes with new ones, had pitched some state governors against the President.

Insisting on the order of the apex court, the governments of Kaduna, Ogun and Sokoto had said the people in their states should continue to use the old naira notes as legal tender until the Supreme Court delivered its final pronouncement on the case pending before it.

The Supreme Court order was a sequel to a suit filed by Zamfara, Kogi and Kaduna state governments against the Attorney-General of the Federation.

On Sunday, the All Progressives Congress chairman, Senator Abdullahi Adamu and the National Working Committee of the party met with 12 APC governors and admonished the CBN and the AGF, Abubakar Malami, SAN, to comply with the order of the apex court.

Commenting on the violence that rocked the town, the Akarigbo of Remo, Oba Babatunde Ajayi, sued for calm, noting that the CBN cash policy was not masterminded by the state or local government.

The monarch in a statement said, “I appeal to all to remain calm and peaceful as we continue to engage the Federal Government. This policy is not from the state or local government. Therefore, the destruction of lives and properties will only compound an already bad situation.

“I urge our people to continue to accept the old notes in line with the Supreme Court ruling. No person who accepts the old notes would lose out. I can assure you of that, and please hold on to that promise.”

“Further, I am also mandating all our market people to continue to accept the old notes. I hereby undertake that no one will lose out for possessing the old no.

0 Comments