Nigeria is overripe for a deeper penetration of existing cashless programme introduced since 2012. However, force should not be a factor in its implementation. Persuasion and motivation are better driving elements of the laudable programme.

The first step is raising confidence level, the led should have more trust in their leaders. It is up to the leaders to raise the bar of confidence of their constituents. Such facilitate acceptance of policies and introduced programmes. Regulatory framework should protect more deposits and the transactions of users of payment platforms. Vulnerable people should have better protection, laws to shield commoners should be enacted, existing laws if need be can be improved upon to further protect the populace.

Sensitisation on benefits of opting for cashless option of doing financial deals further stamps the policy in the people’s minds. Currencies are potentially germ hosts. They are potential means of transfer of disease causing agents that are less visible to the eyes. Places where money is kept such as pockets, wallets and areas close to bodies render them substrates for germs, dirty palms and fingers and use of saliva in counting money contribute in no small measure to how unhygienic some notes can be. Creating awareness on this could impact on a massive switch away from cash.

The Central Bank of Nigeria as well as the National Orientation Agency has responsibility for creating awareness on benefits of cashless transactions. Another round of road trips nationwide as well as town halls can be introduced once again.

Last quarter of 2022 and first quarter of the new year saw a major growth in bank transfers, use of Point of Sale terminals and related channels of exchange without cash, recorded to be over 200 percent.

Nigeria, a country of over 200 million, can actually have a higher volume of online financial transactions provided the transfer platforms are upgraded to accommodate more exchanges. Presently, glitches of various forms and dimensions resulting in complaints accompany some of the transactions.

There is a need to reduce the remedial period coupled with the fact that some of the hiccups in transfers should be handled free. How can someone spend N500 to bank over a N200 failed transaction?

Charges for exchange should be reduced as another attraction for people to initiate low amount transactions. Envisaged volume of transactions at lower rates has a tendency to generate more than enough revenue for all parties involved. Settlement and resolution of settlement issues should also be worked out and made transparent.

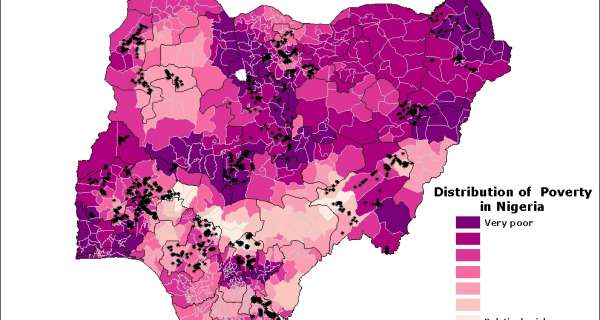

Kenya has a higher level of cashless penetration, about 80 percent of all transactions, Nigeria, the Giant of Africa, ought not to trail the east African country of a lesser population and landmass.

Employers ought to be sensitised on how going cashless reduces the workload of their staff handling cash. Financial institutions will be saving a reasonable amount of money as less cash gets used. The rural population are today familiar with smartphones. They are fast catching up with modern trends with some more sensitisation the rural areas can also key into the programme.

There are safety and security benefits of reduced cash transactions. With significant reduction in cash deals across the country, those handling huge cash in such situations open themselves to scrutiny. It is not too late for Nigeria to go cashless but it cannot be achieved holding people by the jugular.

0 Comments